Similar Working day Funding available for customers finishing the personal loan system and signing the Promissory Be aware by four:00PM ET on a company working day. Also note, the ACH credit score might be submitted to the lender a similar company day.

May possibly address emergencies: In the event you’re unable to operate and are looking forward to your software for being processed, disability loans fill that hole.

If you’re on SSI, you'll want to program your mortgage meticulously. For those who don’t devote your entire personal loan during the month you receive it, All those money will rely to the $two,000 asset limit. In the event you’re earlier mentioned that, you may eliminate your Advantages for that thirty day period.

Pay out a lot more than the minimum amount: Strive to pay more than the bare minimum equilibrium required in your debts, regardless of whether it’s just yet another $ten a month. Each individual added payment helps in lessening the general personal debt burden. The tips contained in this post are suitable for informational needs only.

It is possible to perhaps use your authorities aid earnings to get quick cash loans, such as hard cash progress loans and payday loans. On the other hand, you are still subject to the lender’s eligibility standards.

Credit score rating. Preferably, you need a credit score of no less than 580, but some lenders — like installment lenders and funds apps — haven't any credit history score necessity.

*DISCLOSURE: This can be a solicitation for an installment mortgage or progress of credit score. This is not a confirmed offer you and is also subject to lender's acceptance and a complete and authorised application. Success and true loan quantities may well vary by state.

Various lender selections: You've got a plethora of lenders, banking institutions or credit history unions to select from With regards to getting a mortgage that actually works to suit your needs.

As a reminder, make sure you be certain that you fulfill every one of the eligibility requirements and read from the terms and conditions ahead of applying and producing a decision on whether it is best for you.

Provide evidence of your respective disability Positive aspects, for instance award letters or lender statements, to assure lenders of the cash flow balance.

Some programs may well need supplemental verification, during which circumstance the mortgage, if permitted, will likely be funded the business enterprise day soon after these types of added verification is accomplished.

Determine the amount time you want for repayment before you choose a disability financial loan. A brief repayment term will Value fewer simply because you usually fork out less fascination costs.

When these loans can seem to be desirable to folks on disability who are getting difficulty making finishes meet, they must only ever be considered as A final resort.

Remember: In the event you’re implementing for a personal mortgage, Examine to you should definitely’re qualified ahead of applying — as each individual tough credit history pull can ding your read more credit score by some details.

Melissa Joan Hart Then & Now!

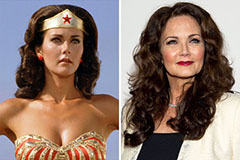

Melissa Joan Hart Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!